Decoding JPMorgan Chase & Co.'s Fourth Quarter 2023 Earnings Report: A Simple Investor's Guide

Investing can be a daunting task, especially when faced with complex financial jargon. But fear not, as we break down JPMorgan Chase's fourth-quarter 2023 earnings call into digestible insights for simple investors.

Understanding the Numbers:

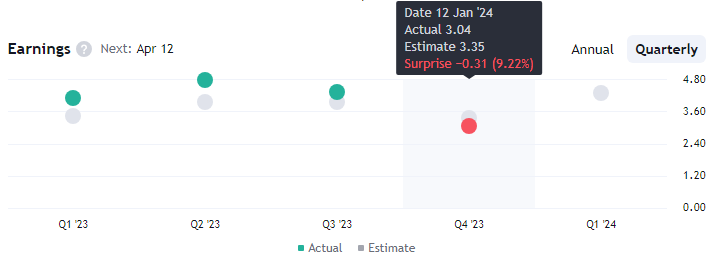

JPMorgan Chase JPM 0.00%↑ reported impressive figures for the fourth quarter of 2023. The firm's net income stood at $9.3 billion, with earnings per share (EPS) reaching $3.04 on revenue of $39.9 billion. Return on Tangible Common Equity (ROTCE) was reported at 15%.

It's important to note that these numbers include certain exceptional items, such as a special assessment by the Federal Deposit Insurance Corporation (FDIC) and net investment securities losses. Excluding these exceptional items, the firm's performance remains robust.

Key Highlights:

Revenue Growth: The firm witnessed a 7% year-on-year increase in revenue, primarily driven by higher rates. However, expenses also surged by 24%, mainly due to the FDIC special assessment and increased compensation costs.

Credit Performance: Credit costs amounted to $2.6 billion, reflecting net charge-offs and reserve build-up. Net charge-offs were predominantly driven by card and single-name exposures in the wholesale segment.

Full-Year Results: For the entire fiscal year, JPMorgan Chase reported net income of $50 billion, EPS of $16.23, and revenue of $162 billion, achieving an ROTCE of 21%.

Business Segments Overview:

Consumer & Community Banking (CCB): Despite facing challenges like lower deposit balances, CCB reported a solid performance with net income of $4.4 billion on revenue of $17 billion, driven by higher rates and strong account growth.

Corporate & Investment Bank (CIB): CIB reported net income of $2.5 billion on revenue of $11 billion. Investment banking revenue surged by 13% year-on-year, reflecting increased capital markets activity.

Commercial Banking: Commercial banking witnessed a 7% year-on-year increase in revenue, primarily due to higher Net Interest Income (NII) and increased capital markets activity. However, credit costs rose due to a deterioration in commercial real estate valuation outlook.

Asset & Wealth Management (AWM): AWM reported net income of $925 million, driven by higher management fees on strong net inflows and higher market levels. Assets under management (AUM) and client assets witnessed significant growth year-on-year.

Corporate: The corporate segment reported a net loss, primarily due to higher expenses driven by the FDIC special assessment.

Outlook for 2024:

Looking ahead, JPMorgan Chase expects NII to be approximately $88 billion, assuming rates follow the forward curve. Expenses are projected to be around $90 billion, reflecting investments in business growth and technology. Credit performance is expected to remain stable, with the card net charge-off rate below 3.5%.

Conclusion:

In summary, JPMorgan Chase's JPM 0.00%↑ fourth-quarter 2023 earnings call reflects a strong performance amidst challenges. While the outlook for 2024 suggests a path towards normalization, the firm remains optimistic about its ability to deliver superior returns. For simple investors, understanding these key metrics and business segments can provide valuable insights into the performance and future prospects of the company.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.*