Exploring Dividend Stocks in the Robust German Market

As of May 2024, the German stock market has experienced a significant uptick, with the DAX index climbing by 4.28%.

This increase is part of a broader European trend driven by better-than-expected corporate earnings and a growing sentiment that central banks may soon reduce interest rates.

In this favorable economic environment, dividend stocks have become particularly appealing to investors seeking steady income streams. Let’s explore what makes a good dividend stock and examine three notable German companies: MLP SE, PWO AG, and Schloss Wachenheim AG.

What Makes a Good Dividend Stock?

When looking for quality dividend stocks, investors should consider the following factors:

Stable Earnings: Companies with consistent earnings are more likely to maintain and grow their dividend payouts.

Strong Balance Sheets: Low debt levels and strong cash reserves support dividend sustainability.

Dividend History: A track record of regular dividend payments indicates reliability and commitment to returning value to shareholders.

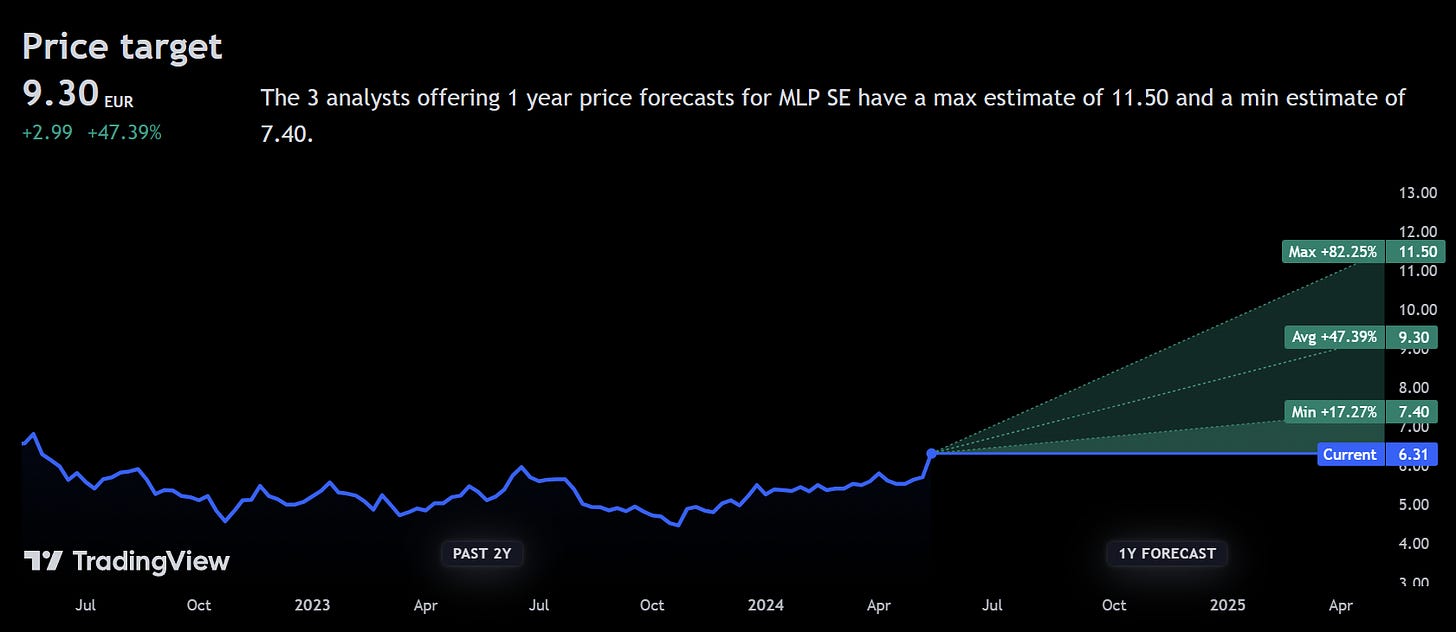

MLP SE: A Financial Services Provider

Overview:

Market Capitalization: €0.63 billion

Dividend Yield: 5.1%

Operations:

MLP SE offers financial services to private, corporate, and institutional clients in Germany. Its revenue streams are diverse, including financial consulting (€0.42 billion), FERI (asset management, €0.21 billion), banking (€0.18 billion), DOMCURA (insurance services, €0.13 billion), real estate (€0.06 billion), and industrial broker services (€0.03 billion).

Dividend Sustainability:

MLP SE pays a dividend of €0.30 per share, which is covered by both earnings (67.4% payout ratio) and cash flows (32.6% cash payout ratio). Despite a slight decline in net income and earnings per share from the previous year, MLP’s dividend appears sustainable. Additionally, the stock is trading at 35.9% below its estimated fair value, suggesting potential undervaluation.

PWO AG: Manufacturer for the Mobility Industry

Overview:

Market Capitalization: €98.75 million

Dividend Yield: 5.5%

Operations:

PWO AG specializes in producing and selling construction components from steel and aluminum sheets for the mobility industry, operating in Germany, Czechia, Canada, Mexico, and China. The company’s primary revenue source is its Auto Parts & Accessories segment, generating €556.31 million.

Dividend Sustainability:

With a dividend yield of 5.5%, PWO AG has shown financial improvement, reporting a net income growth to €16.22 million for 2023. The payout ratio from earnings is 33.7%, and from cash flows, it’s 41.3%, indicating reliable coverage. Although PWO has a high debt level and a historically volatile dividend, the stock trades at a 23.9% discount to its estimated fair value, offering potential value to investors.

Schloss Wachenheim AG: Sparkling Wine Producer

Overview:

Market Capitalization: €121.97 million

Dividend Yield: 3.9%

Operations:

Schloss Wachenheim AG produces and distributes sparkling and semi-sparkling wines across Europe and internationally.

Dividend Sustainability:

Schloss Wachenheim has consistently grown its dividend over the past decade, with a current yield of 3.9%. However, its dividends are poorly covered by cash flows (cash payout ratio of 113.1%). Recent financials show a troubling trend, with Q3 sales increasing to €87.13 million but a net loss of €3.07 million, which has worsened compared to the previous year’s loss of €0.502 million. Despite this, the stock is trading at 79.6% below its estimated fair value, and analysts expect a price increase.

In the current market climate, characterized by cautious optimism and potential policy easing, dividend stocks like MLP SE, PWO AG, and Schloss Wachenheim AG offer intriguing opportunities. While MLP SE and PWO AG present strong dividend yields with potential undervaluation, Schloss Wachenheim AG's stable but lower yield might appeal to more conservative investors despite its recent financial struggles. As always, investors should carefully consider each company's financial health and dividend sustainability before making investment decisions.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.