How Interest Rates Actually Affect Stocks (Retail Version)

A simple breakdown of how interest rates affect stocks, sectors, and market behavior, written specifically for retail traders and investors.

Interest rates are one of the most talked about topics in financial media. Every rally, selloff, and sideways market seems to get blamed on them.

“Rates are going up.”

“Rates are staying higher for longer.”

“Rates are coming down soon.”

Retail traders hear these phrases constantly, but very few understand what they actually mean for price action.

What Interest Rates Really Represent

Interest rates are the price of money.

When rates are low, borrowing is cheap. When rates are high, borrowing is expensive.

That sounds simple, but the real impact comes from how rates change behavior across the system.

Rates influence:

Corporate borrowing

Consumer spending

Investment flows

Valuations

Risk appetite

Liquidity availability

Stocks do not react to rates in isolation. They react to how rates affect liquidity and expectations.

Why Stocks Do Not Move One-to-One With Rates

A common retail assumption is:

Rates up = stocks down

Rates down = stocks up

Reality is far more nuanced.

Markets move on expectations, not just outcomes.

If rate hikes are expected and already priced in, stocks may rally when rates rise. If cuts are expected and fail to happen, stocks can sell off even when rates stay flat.

The market trades surprise, not headlines.

The Timing Problem Most Retail Traders Miss

Rates affect stocks on different timelines.

Short Term

Rate decisions create volatility, not trend.

You often see:

Initial spikes

Fakeouts

Reversals

Whipsaws

This is why trading directly off rate headlines is dangerous.

Medium Term

This is where rates begin to influence:

Sector rotation

Valuation adjustments

Earnings expectations

Growth stocks, rate sensitive sectors, and leveraged companies start to diverge.

Long Term

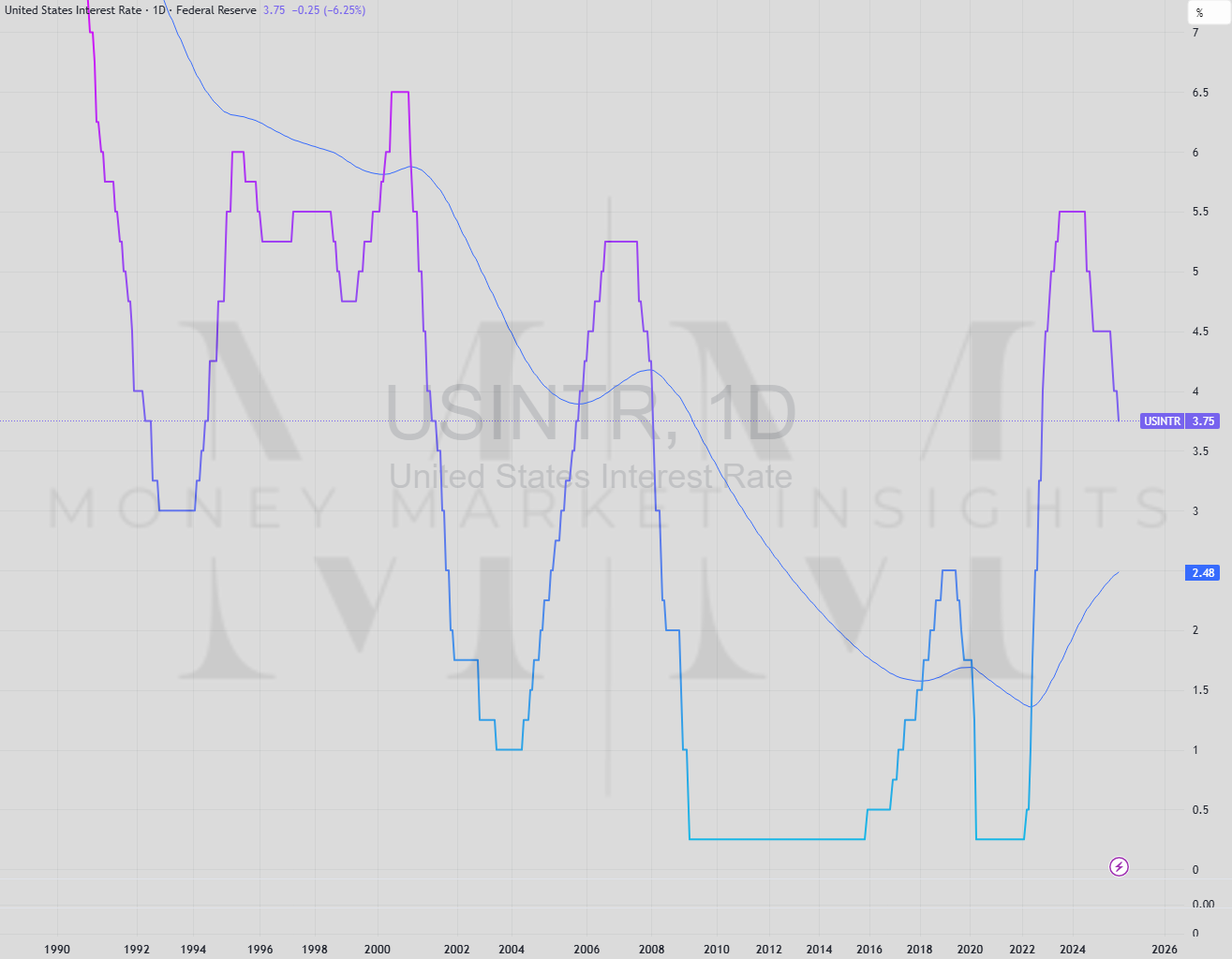

Sustained rate regimes shape:

Bull and bear markets

Capital allocation

Risk tolerance

Market cycles

This is where the real impact shows up.

How Interest Rates Affect Stock Valuations

One of the most important concepts for traders to understand is discounting.

Stocks are priced based on expected future cash flows. Interest rates affect how those future cash flows are valued today.

When rates rise:

Future earnings are discounted more heavily

High growth stocks suffer more

Valuations compress

When rates fall:

Future earnings become more valuable

Growth stocks benefit

Valuations expand

This is why technology stocks are often more sensitive to rate changes than defensive sectors.

Why Some Stocks Go Up Even When Rates Rise

This confuses many traders.

Stocks can rise during rate hikes when:

Economic growth remains strong

Earnings continue to expand

Inflation expectations stabilize

Rate hikes are slow and predictable

In these cases, rising rates signal confidence in the economy rather than stress.

The context matters more than the rate itself.

Sector-Level Effects of Interest Rates

Rates do not impact all stocks equally.

Sectors That Tend to Struggle With Higher Rates

Technology

High growth stocks

Unprofitable companies

Highly leveraged firms

These rely heavily on future earnings and cheap capital.

Sectors That Can Benefit From Higher Rates

Financials

Energy

Industrials

Value oriented stocks

Banks, in particular, can benefit from wider interest margins.

Rate Cuts Are Not Always Bullish

Rate cuts often occur during economic stress.

When cuts happen because growth is slowing, stocks can fall despite lower rates. This catches many retail traders off guard.

Again, the reason behind the rate change matters more than the change itself.

How Interest Rates Affect Market Phases

Rates play a major role in market cycles.

Rising rates often coincide with consolidation or late expansion

Falling rates can fuel new expansion phases

Rapid rate changes often increase volatility and transitions

This is why rate environments must be viewed through a market cycle lens, not a single trade lens.

How Retail Traders Should Actually Use Rate Information

This is where things get practical.

1. Use rates for context, not entries

Rates help you understand the environment. They do not give precise buy or sell signals.

2. Watch expectations, not headlines

What the market expects matters more than what the central bank says.

Surprises move price. Confirmations often do not.

3. Combine rates with price action

Price always has the final say.

If stocks rally despite bad rate news, that information matters.

4. Respect volatility around rate events

Rate announcements distort normal price behavior. Reduce size or sit out if needed.

5. Think in phases, not days

Rates influence markets over weeks and months, not minutes.

Align your strategy with the broader environment.

Common Retail Mistakes Around Interest Rates

Trading headlines instead of structure

Assuming rate cuts are always bullish

Ignoring expectations

Overreacting to short term volatility

Treating macro as a timing tool

Macro is a compass, not a stopwatch.

Interest rates matter, but not in the way most retail traders think.

They shape liquidity, expectations, and market phases over time. They do not hand you instant trade signals.

When you stop reacting to rate headlines and start using rates as context, your decision making becomes calmer, clearer, and far more effective.

Understand the environment first. Trade the structure second. Let price do the talking.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.