Inflation Report Days: How Markets Really React (Data Backed)

A data-backed breakdown of how markets react on CPI and PCE inflation report days, what patterns repeat, and how retail traders should adjust risk and expectations.

Inflation report days feel important because they are important. CPI and PCE releases can move markets more in minutes than most days move in hours.

But most retail traders misunderstand how markets react on inflation days. They expect clean directional moves. What they often get instead is chaos, reversals, and whipsaws that feel random.

They are not random.

Markets behave very differently on inflation report days, and those behaviors repeat far more often than people realize.

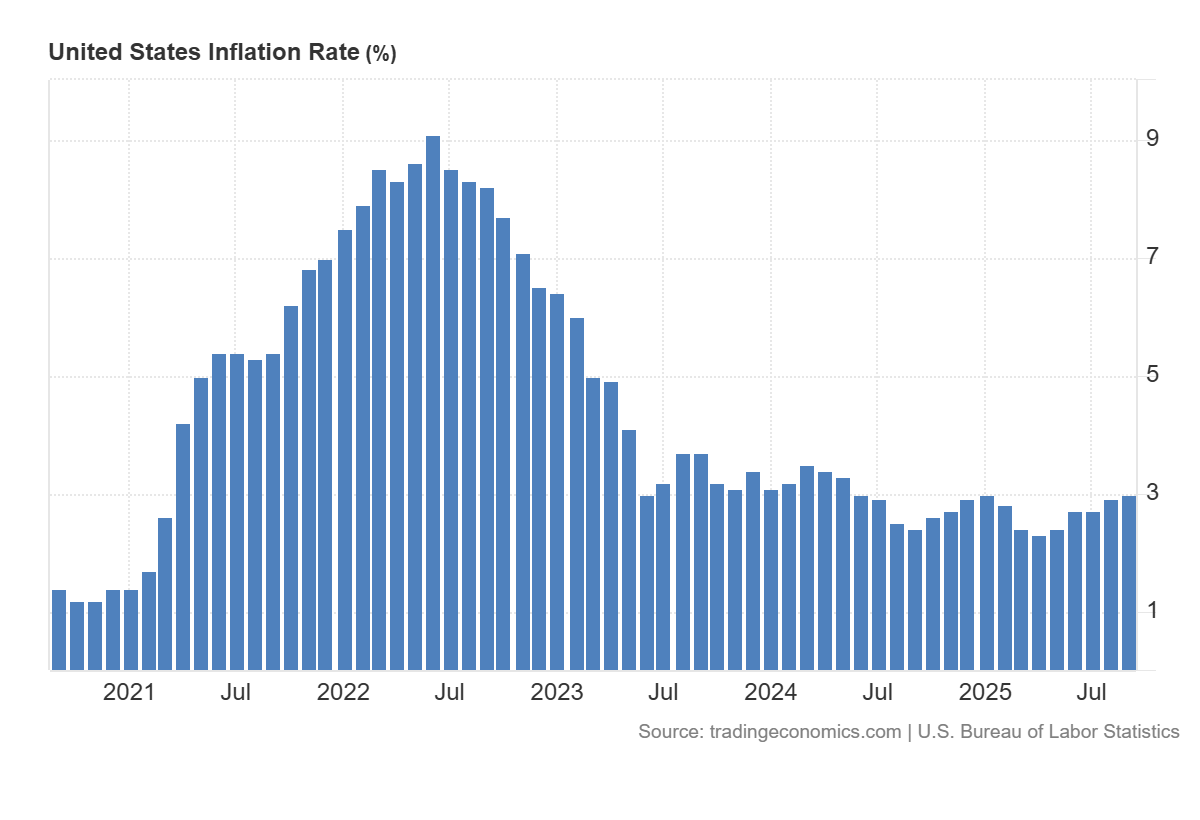

Why Inflation Reports Matter So Much

Inflation reports directly influence expectations around:

Interest rates

Monetary policy

Liquidity conditions

Corporate margins

Consumer demand

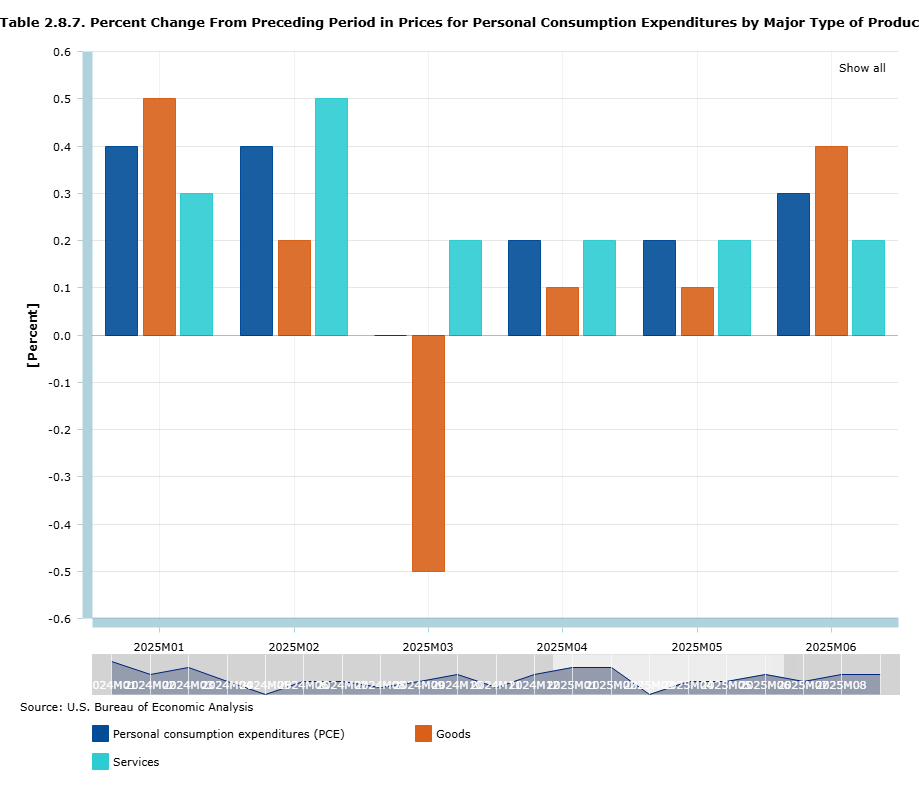

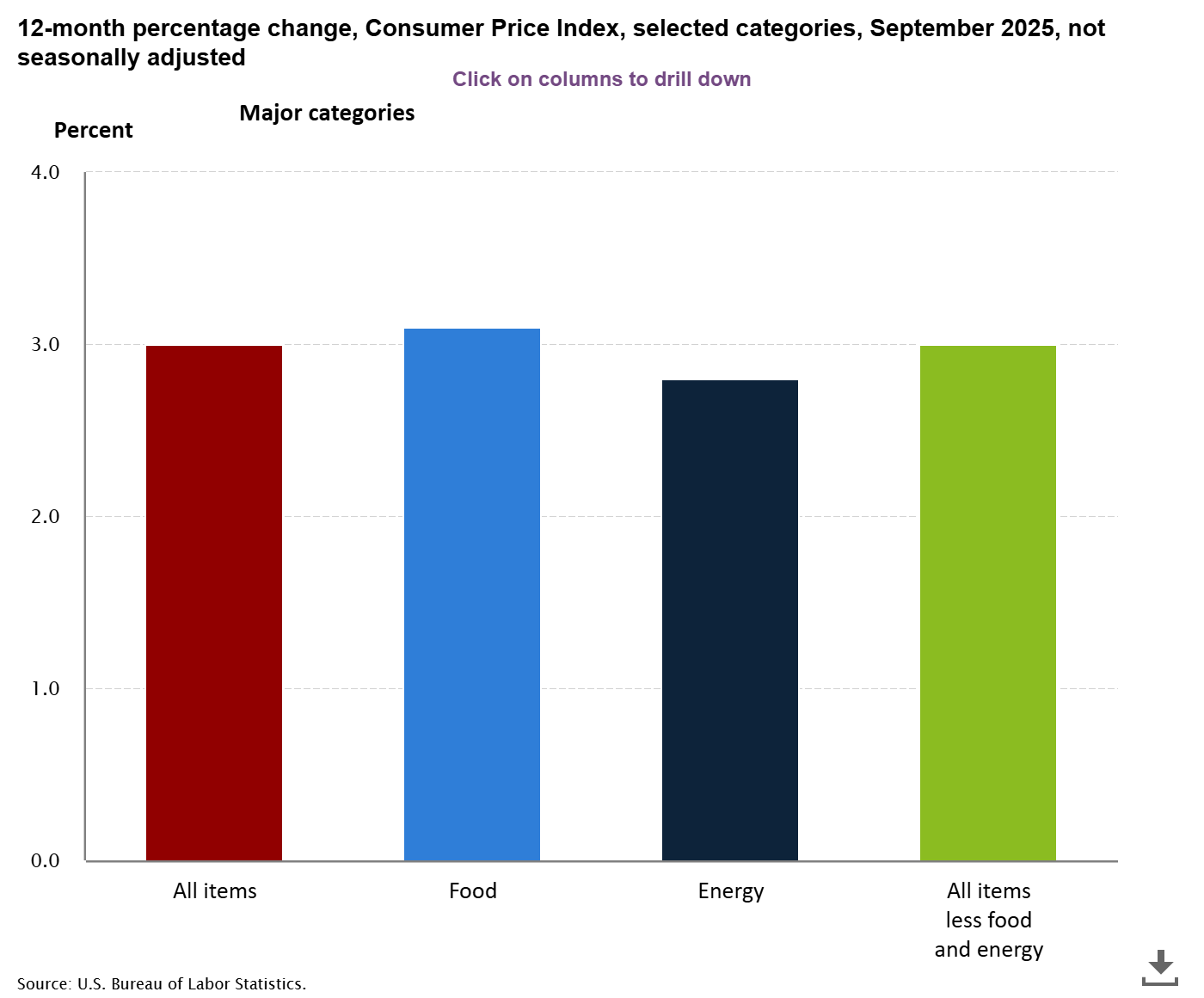

CPI and PCE do not just report data. They shape expectations about what the central bank will do next.

Markets are not reacting to the number alone. They are reacting to what the number changes about the future.

The Most Important Concept Retail Traders Miss

Markets do not trade inflation. They trade surprise relative to expectations.

If inflation comes in high but matches expectations, markets often rally. If inflation comes in low but expectations were lower, markets can sell off.

The headline number means very little without context.

This is why inflation days confuse retail traders who only read the news.

What the Data Shows About Inflation Report Days

Looking across CPI and PCE releases from 2020 through 2025, several repeatable behaviors stand out across ES, NQ, and SPY.

1. Volatility Expands Immediately

On average:

The first 5 to 15 minutes after release show significantly higher volatility

Wicks are longer

False breakouts are more common

This is price discovery, not trend formation.

Early movement is often emotional and liquidity driven.

2. Initial Direction Is Often Wrong

A common pattern:

Sharp move up or down immediately after the release

Quick reversal within minutes

Second move becomes the real move

This happens because:

Algorithms react instantly to the data

Liquidity is thin

Stops cluster near obvious levels

Institutions wait for positioning opportunities

Retail traders often enter on the first move and get trapped.

3. The Opening Range Still Matters

Even on inflation days, structure matters.

Data shows that when:

The opening range holds after the initial spike

Price reclaims or loses the opening range cleanly

Continuation probability improves dramatically.

Inflation days amplify ORB behavior. They do not invalidate it.

4. Inside Opens Create Chaos

When the market opens inside the prior day’s range on an inflation day:

Fakeouts increase

Mean reversion dominates early

Direction often takes longer to establish

These are the hardest inflation days to trade.

5. Volume Confirmation Is Critical

Breakouts without volume on inflation days fail more often than on normal sessions.

High probability moves show:

Volume expansion

Follow through after the initial reaction

Acceptance beyond key levels

No volume means no conviction.

Why Inflation Days Feel So Unforgiving

Inflation days compress multiple market forces into a short window:

Macro repricing

Liquidity adjustment

Position unwinds

Risk reduction or expansion

This creates:

Faster moves

Larger candles

More emotional decision making

Markets are not being irrational. They are repricing quickly.

Common Mistakes on Inflation Days

These mistakes show up repeatedly.

1. Trading the number instead of the reaction

The number is not the trade. Price reaction is the trade.

2. Entering too early

Early moves are often liquidity grabs. Patience dramatically improves outcomes.

3. Using normal position size

Volatility is higher. Risk must be lower.

4. Expecting clean trends immediately

Most inflation days require structure to form first.

5. Overtrading the noise

More movement does not mean more opportunity.

How to Trade Inflation Days the Right Way

1. Reduce size automatically

Inflation days are not the time for full size.

2. Let the first reaction happen

Do not rush. Let liquidity clear.

3. Trade structure, not headlines

Focus on:

Opening range

Key Price Levels

VWAP

Prior high and low

These levels still control behavior.

4. Look for acceptance, not spikes

Acceptance means:

Candles closing beyond levels

Follow through

Volume confirmation

Spikes alone are meaningless.

5. Be selective or sit out

Some inflation days offer one good trade. Some offer none.

Capital preservation is a win.

How Inflation Days Fit Into Market Cycles

Inflation reports often accelerate phase transitions.

Strong surprises can kick off expansion

Conflicting data can trigger consolidation

Repeated inflation shocks increase volatility regimes

This is why inflation days matter more than most single-session catalysts.

Inflation report days are not random chaos. They are compressed information days where liquidity, expectations, and positioning collide.

Retail traders struggle because they try to trade inflation like a normal session.

The traders who perform best on inflation days:

Reduce size

Wait for structure

Respect volatility

Trade confirmation

Accept that not trading is often the best decision

Inflation days reward patience, discipline, and context. Not speed.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.