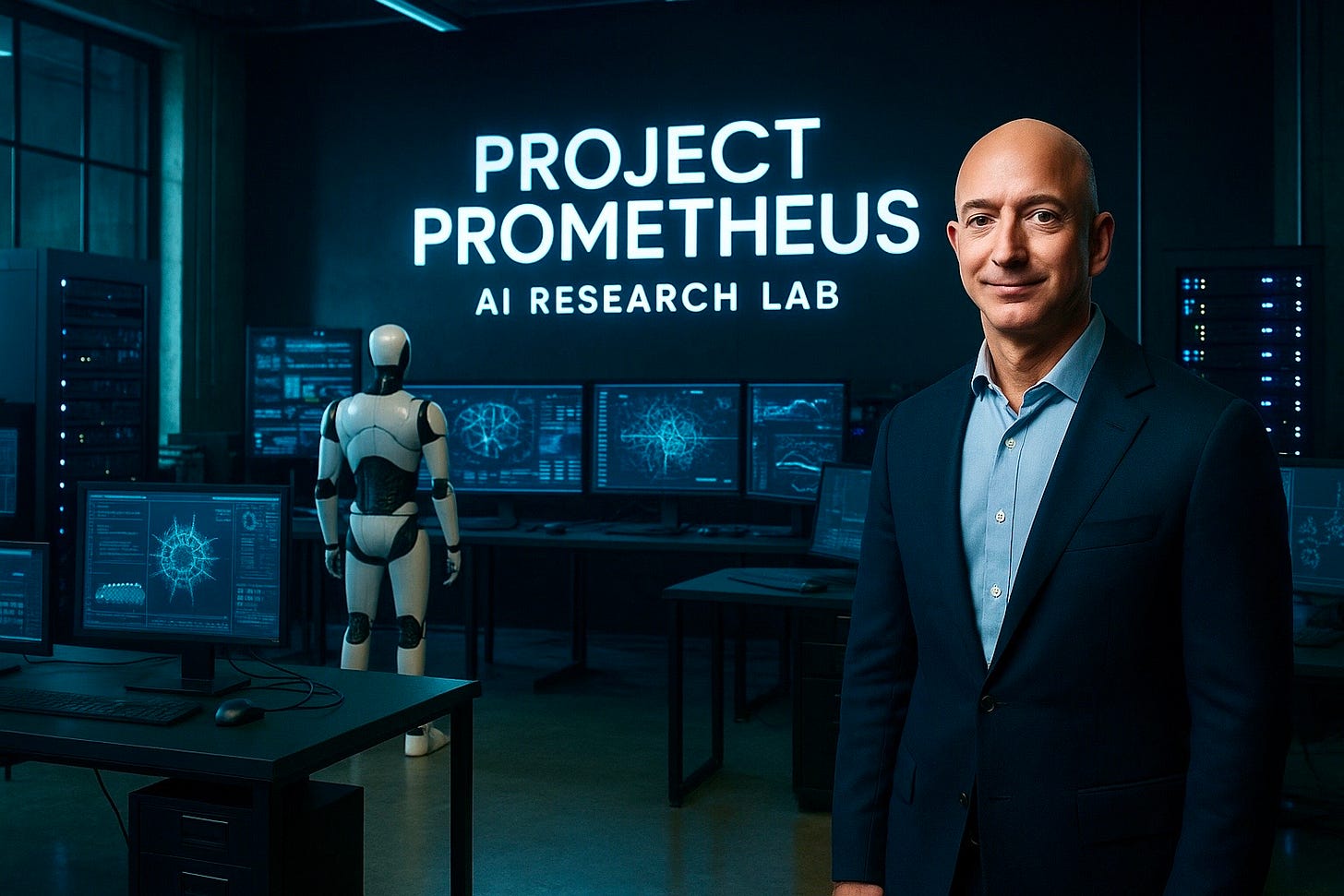

Project Prometheus: Jeff Bezos’ $6.2 Billion AI Bet on the Physical Economy

A deep dive into Project Prometheus. What we know, why it matters, and what it could mean for investors and the tech-industrial future.

A deep dive into Project Prometheus what we know, why it matters, and what it could mean for investors and the tech-industrial future.

Jeff Bezos is stepping into an operational role again this time as co-CEO of Project Prometheus, a stealthy new artificial-intelligence startup reportedly backed with $6.2 billion in early-stage funding.

The company’s stated focus is “AI for the physical economy” targeting manufacturing, engineering, aerospace, automotive and compute hardware.

For investors and technology strategists, the move signals more than another AI-software firm. It suggests a push into the physical systems + AI convergence arguably one of the less discussed yet high-impact frontiers.

What We Know So Far

Founders and leadership

Jeff Bezos will serve as co-CEO of Project Prometheus.

His co-CEO partner is Vik Bajaj, a physicist/chemist formerly with Google X and Verily.

Funding & size

The startup has raised approximately US$ 6.2 billion in early-stage funding.

It is reported to have already nearly 100 employees, recruited from top AI firms including OpenAI, DeepMind and Meta Platforms.

Strategic focus

The work is described as “AI for the physical economy” i.e., applying AI to manufacturing, compute hardware, aerospace/automotive engineering.

The exact location, launch date and detailed product roadmap are still highly secretive.

Why It Matters: Strategic Implications

1. Shift from software to physical systems

Many AI companies focus on models, datas, training, and cloud. Project Prometheus may occupy a different niche building AI that controls, manufactures, optimizes physical systems. That’s a discussion point often overlooked in tech investment circles.

2. Bezos’s re-entry into operations

Bezos hasn’t taken a formal operational role since stepping down as CEO of Amazon in 2021. This signals high personal commitment which may draw more scrutiny, talent, and capital.

For investors, that means this won’t quietly coast; it could aim to be a major player.

3. Massive funding = high expectations

Being one of the best-funded early stage AI startups places enormous pressure on results. That’s both a tailwind & a risk.

4. Competitive landscape & timing

The physical-AI segment is contested: companies such as robotics firms, hardware AI firms, industrial automation firms all play here. Project Prometheus will need to carve a unique value proposition. Timing and execution will be critical.

What to Watch: Investor Checklist

Here’s what you should track if you’re positioning around Project Prometheus (either directly or indirectly via related sectors):

Talent acquisitions & departures: Who joins/promoted from companies like OpenAI/DeepMind?

Recruiting manufacturing / physical-systems engineers: A sign they’re serious about physical infrastructure.

Partnership announcements: For example aerospace/automotive/manufacturing firms teaming with Project Prometheus.

Location & facility news: Establishing labs/factories will signal scale-up.

Funding milestones or new capital calls: Could indicate burn or scaling.

Public product or demo launches: Even minimal showcase would shift market perception.

Competitive moves: How incumbents respond (e.g., Nvidia, AMD, robotics firms).

Valuation and investment flows in the sector: If physical-AI becomes a theme, this could influence multiple companies.

Risks & Caveats

Secrecy = unknowns: Without public roadmap, much is speculation.

Execution risk is very high: Manufacturing + hardware + AI = complex combinations.

Capital intensity and burn: $6.2B is large, but hardware/physical systems can burn even more before revenue.

Competitive pressure: Companies with existing hardware/AI infrastructure might have advantage.

Time horizon: These things often take years to pay off; not a short-term ticker trade.

Implications for Related Investments

Even if you can’t invest in Project Prometheus directly (it’s presumably private for now) the announcement creates a ripple effect:

Hardware / sensor / robotics companies may see renewed interest.

Manufacturing automation firms may benefit from increased AI-physical system focus.

Aerospace/automotive firms collaborating with AI startups may gain strategic value.

Valuation of AI startups may shift emphasis from just “models” to “machine + model + hardware” combos.

Project Prometheus is a potentially major milestone in the evolution of AI not just another model-startup, but a venture aiming to merge AI with engineering and manufacturing at scale. For investors, the key is to monitor signals of execution, talent & partnerships, and whether this becomes a broader industrial theme. Consider it a watchlist candidate, with high upside and high risk but one that could define the next chapter of tech beyond just software.