Rivian Automotive Stock Soars Amid EV Tariff Talks: Is It Time to Invest?

Rivian Automotive RIVN 0.00%↑ has been making headlines recently with its surging stock prices, particularly jumping as much as 12% in early trading on a recent Monday.

For beginners in investing, understanding what's driving this surge and whether it's a good time to invest requires a closer look at the company's recent developments and the broader electric vehicle (EV) landscape.

What's Driving Rivian's Surge?

Rivian's recent momentum can be attributed to a combination of factors. The company unveiled its next-generation lineup of midsize electric SUVs in March, which garnered positive attention. Additionally, a substantial funding grant from the State of Illinois Department of Commerce and Economic Opportunity provided a boost, helping Rivian save over $2.25 billion in capital spending as it expands its Illinois factory.

Moreover, reports of the Biden administration planning to announce significant new tariffs on EVs and other goods imported from China have further fueled investor optimism. These tariffs, if implemented, could potentially quadruple existing rates, providing a competitive advantage for U.S.-based EV makers like Rivian.

The Current Landscape of EV Investing

Understanding the broader EV landscape is crucial for evaluating Rivian's investment potential. While EVs have been a hot sector in recent years, the market dynamics are evolving. Growth in EV sales is slowing down, while competition is intensifying, leading to pricing pressures and lower profit margins. This trend poses challenges for smaller players like Rivian, especially in terms of scalability and profitability.

Rivian's Financial Performance and Strategic Plans

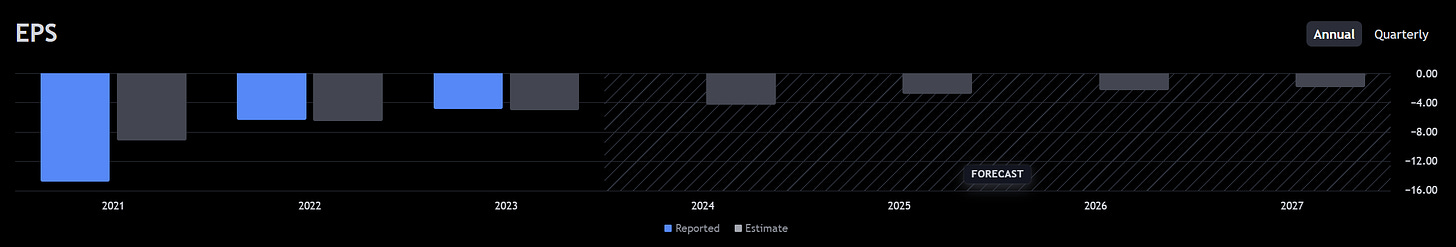

Rivian's recent earnings report reflects the challenges facing the company. While revenue showed significant growth, operating and gross losses remain substantial. However, management remains optimistic about achieving gross profitability by the fourth quarter of this year through increased production volume and manufacturing efficiencies.

Looking ahead, Rivian's strategic plan includes the release of new, more affordable models like the R2, scheduled for the first half of 2026. The R2 aims to capture a broader market segment with its lower price point compared to Rivian's existing lineup.

Is Rivian Stock a Buy?

While Rivian's ambitious plans offer hope for the future, investing in the company at this stage carries significant risks. With substantial cash burn and limited liquidity, Rivian may need to resort to shareholder dilution to raise capital, potentially impacting existing shareholders.

For beginners in investing, it's essential to weigh the potential rewards against the risks before considering investing in Rivian or any other stock. While the company's long-term prospects could be promising if it executes its plans effectively, prudent investors may opt to wait for clearer signs of financial stability and improved liquidity before making investment decisions.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.