For many investors, the quarterly earnings report is a crucial document that provides insights into a company's financial health and performance. However, deciphering these reports can often feel like navigating through a maze of numbers and jargon.

But fear not! With a little guidance and some simplified examples, understanding quarterly earnings reports can become a manageable task even for the novice investor.

1. What is a Quarterly Earnings Report?

A quarterly earnings report, also known as a quarterly financial statement or quarterly earnings release, is a document issued by a publicly-traded company every three months. It provides a snapshot of the company's financial performance during that period, including revenue, expenses, profits, and other key metrics.

2. Key Components of a Quarterly Earnings Report:

Revenue: This is the total income generated by the company from its core business activities. For example, let's consider a fictional company called Tech Innovations Inc. In its quarterly earnings report, Tech Innovations Inc. states that its revenue for the quarter was $100 million. This means the company earned $100 million from selling its products or services during that period.

Expenses: These are the costs incurred by the company in conducting its business operations. Expenses may include manufacturing costs, employee salaries, marketing expenses, and more. Suppose Tech Innovations Inc. reports total expenses of $70 million for the quarter. This indicates that the company spent $70 million to produce and sell its products or services.

Profit (or Loss): Profit, also referred to as net income, is the amount left over after subtracting expenses from revenue. Using our example, if Tech Innovations Inc. generated $100 million in revenue and incurred $70 million in expenses, its profit for the quarter would be $30 million ($100 million - $70 million). This profit represents the company's earnings during the quarter.

3. Analyzing Performance:

Once you grasp these basic components, you can delve deeper into analyzing a company's performance:

Comparative Analysis: Compare the current quarter's results with previous quarters or with the same quarter in previous years. This can help identify trends and assess whether the company's performance is improving or declining over time.

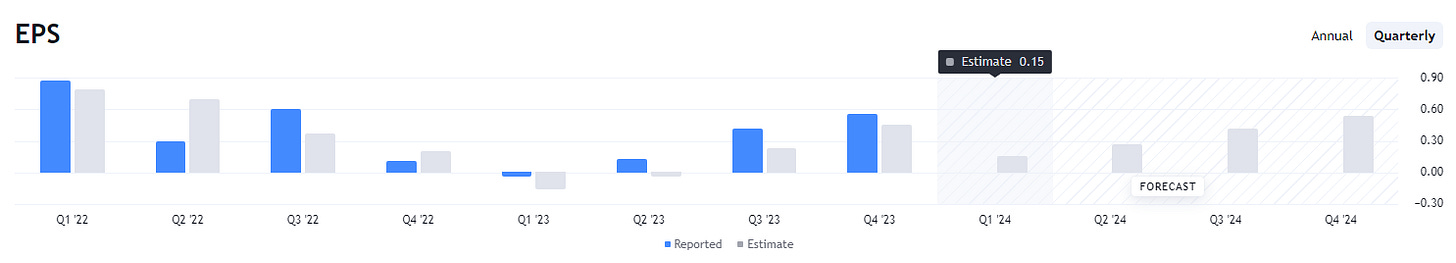

Key Performance Indicators (KPIs): Look beyond just revenue and profit to understand other important metrics such as gross margin, operating margin, and earnings per share (EPS). These indicators provide valuable insights into the company's efficiency, profitability, and growth potential.

4. Understanding Guidance and Outlook:

Many quarterly earnings reports also include forward-looking statements from company management regarding future performance. This guidance may include revenue projections, expense forecasts, and strategic initiatives. Pay attention to this guidance as it can influence market sentiment and stock prices.

Conclusion:

Quarterly earnings reports are invaluable tools for investors seeking to make informed decisions about their investment portfolios. By understanding the key components of these reports and analyzing them in context, even the simplest of investors can gain valuable insights into a company's financial health and prospects for growth.

Remember, while quarterly earnings reports provide valuable information, they should be considered alongside other factors such as industry trends, competitive landscape, and macroeconomic conditions. With practice and patience, you can become proficient at deciphering these reports and making sound investment decisions. Happy investing!

*Disclaimer: The examples and scenarios provided in this article are purely fictional and for illustrative purposes only. Images showcase data from Intel INTC 0.00%↑. Investors should conduct thorough research and seek professional advice before making any investment decisions.*