Decoding Market Cycles & Charting Their Phases

A Beginner’s Path to Smarter Investing

What Are Market Cycles?

A market cycle is a repeating pattern of expansion and contraction in financial markets. While the timeline and triggers can vary, most cycles share four core stages: accumulation, markup, distribution, and markdown. These reflect economic shifts and human psychology.

Four Stages of the Market Cycle

Accumulation (Trough):

Following a recession or sell-off, assets are undervalued. Smart investors quietly buy, often before media attention returns.

Example: April 2025 crash (S&P fell 10%) created buying opportunities.

Markup (Bull Market):

Gradual growth transforms into momentum with higher highs. Investors gain confidence; the public notices.

June 2025 update: The broad market’s summer optimism with index improvements suggests continuation.

Distribution (Peak):

Market peaks with sharp swings. Early sellers lock in profits. Latecomers get greedy.

Current signals: With rising valuations and cyclicals outperforming domestics, the market may be late in its bullish run.

Markdown (Bear Market):

Fear sets in. Prices decline, sometimes sharply. Selling escalates. Bottoming begins when fundamentals stabilize again.

Note: Historically, mid-year summers often begin with modest or sideways movement before seasonal volatility re-emerges.

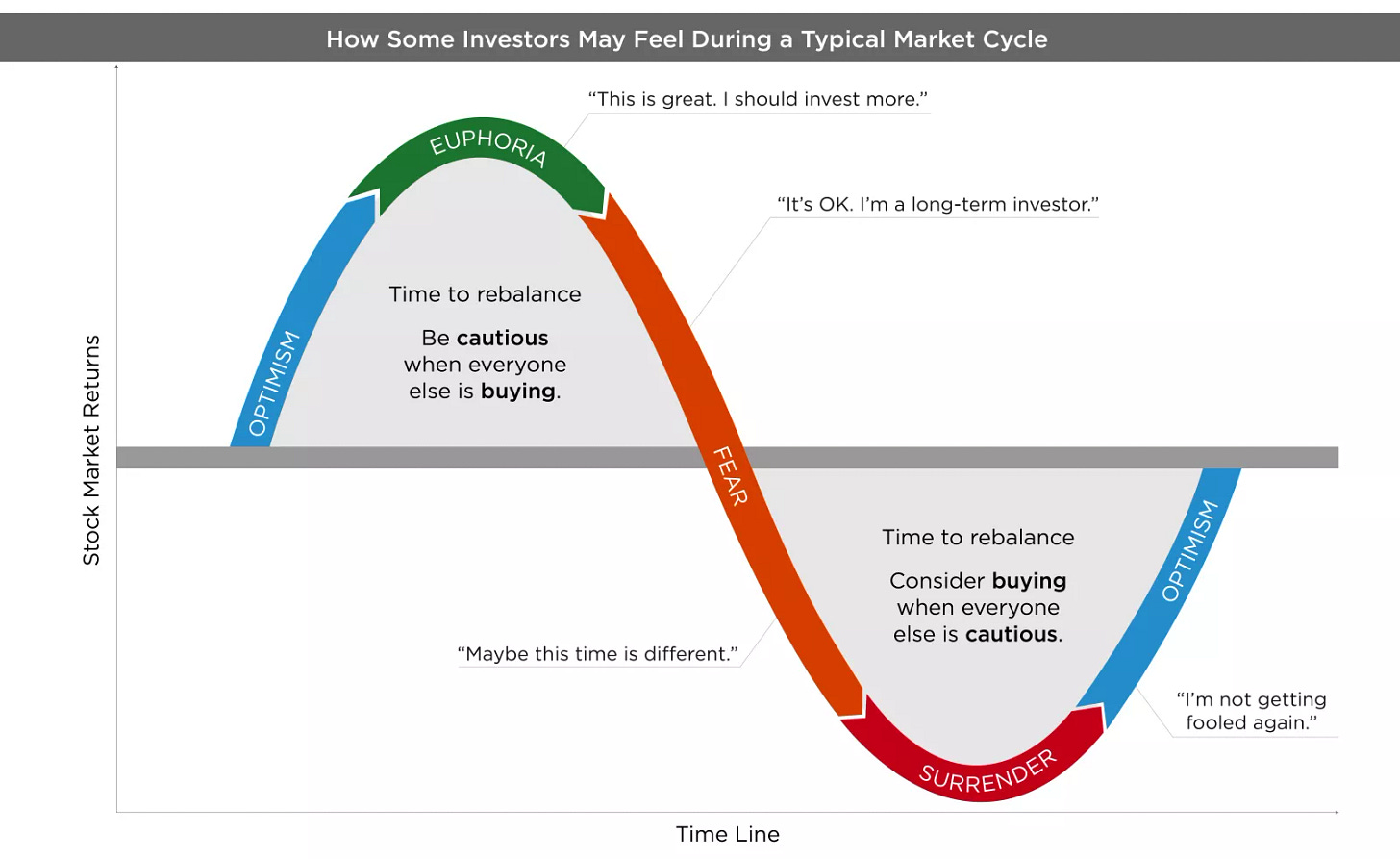

Market Cycle Chart & Emotion Curve

Here’s a classic diagram illustrating the full cycle:

This chart links emotional states to price action helping investors understand not just what happens, but why it happens.

Live Data Snapshot: June 2025

S&P 500 soared above 6,000 in early June which is the highest level since February.1

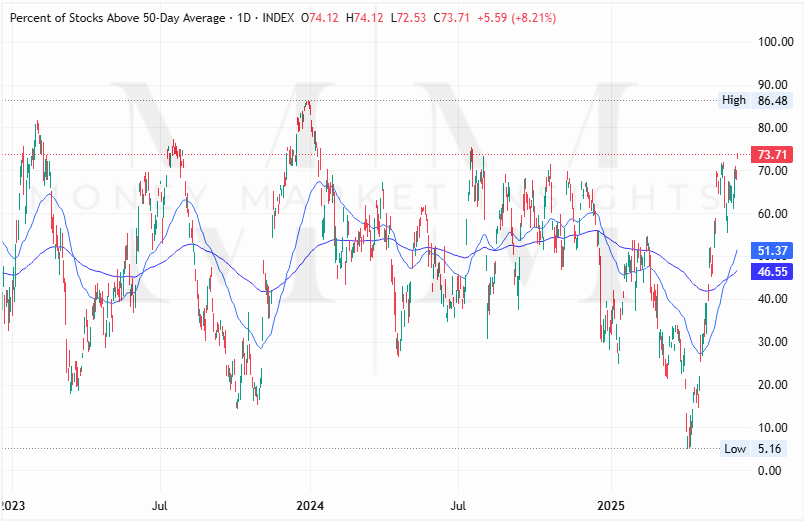

Market breadth: Over 50% of stocks are trading above key moving averages a bullish breadth signal .

Relief rally: After April’s "Liberation Day" crash, markets recovered swiftly but traders remain cautious of seasonal effects.

Why These Cycles Matter to You

Prevent emotional mistakes: Top & bottom signals are often tied to crowd behavior rather than fundamentals.

Tactical planning:

Buy gradually in accumulation

Rebalance or take profits during distribution

Hold cash or bonds in markdown

Diversifying by stage:

Add risk assets early

Shift toward defensive sectors late (e.g., utilities, staples)

Set realistic expectations:

Summer months historically show flat returns; strong May can improve June’s odds.

Practical Tools for Cycle Tracking

Technical analysis: RSI, MACD, moving average trends (image below)

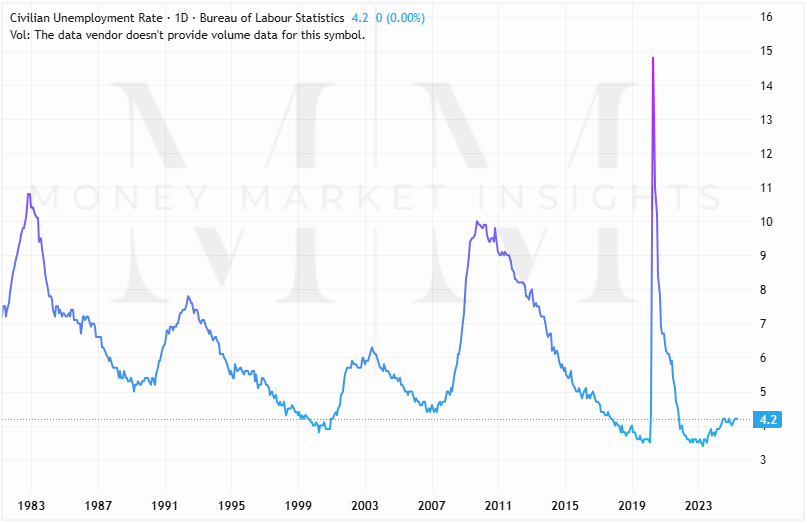

Economic indicators: GDP, unemployment, inflation (image below)

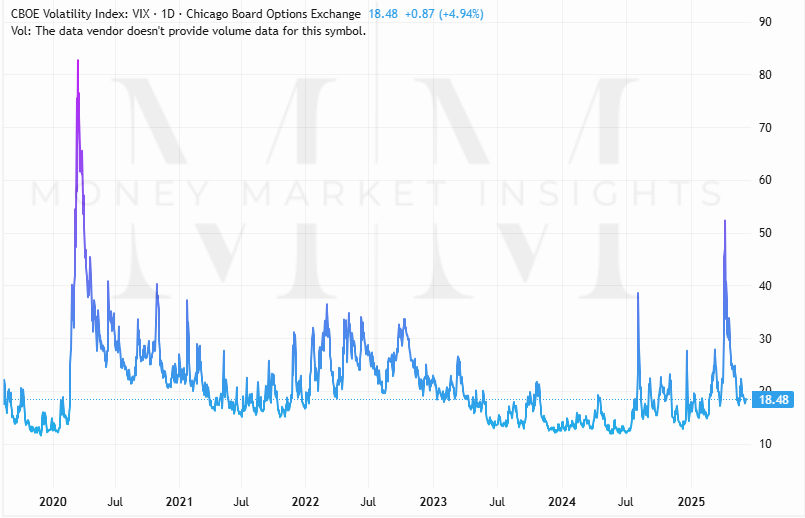

Sentiment tools: VIX, put/call ratios (image below)

Market breadth metrics: % above moving averages, advance-decline lines (image below)

Investor Takeaway Tips

Dollar-cost average during uncertainties

Take profits when euphoria peaks

Build cash cushions before downturns

Stay disciplined, not emotional

Whether in crypto or traditional markets, recognizing market cycles gives you the frame to navigate uncertainty. It doesn’t guarantee perfect timing, but it sharpen your strategy, so you avoid emotional pitfalls and position yourself for long-term success.

*Disclaimer: Not Financial Advice. Investors should conduct thorough research and seek professional advice before making any investment decisions.

SPX as well as SPY 0.00%↑